The Impact of Global Gambling Taxes on Channelization, GDP, and Addiction Rates

Are countries overtaxing gambling at the cost of player protection? This is a question everyone at iGamingCare is asking. Gambling tax policies differ globally, impacting both economic revenues and player behaviors. While some countries enforce high taxation rates on gambling activities, others prefer a moderate approach to encourage a well-regulated legal industry.

This article investigates the impact of global gambling taxation on channelization rates, GDP contributions, and gambling addiction trends. We’ll examine markets including the UK, US, Europe, and others to understand better how effective their gambling taxation models are.

Gambling Taxation VS. Channeling Rates

What exactly is channelization? In terms of gambling, it refers to the percentage of players using legal, regulated platforms as opposed to overseas or unregulated websites.

- High channelization – most players spend their money on legal platforms.

- Low channelization – more players favor offshore and illegal sites.

With regard to gambling taxation policies, the purpose of a robust framework is to promote high channeling, boost player protection efforts, and guarantee a steady flow of tax revenue.

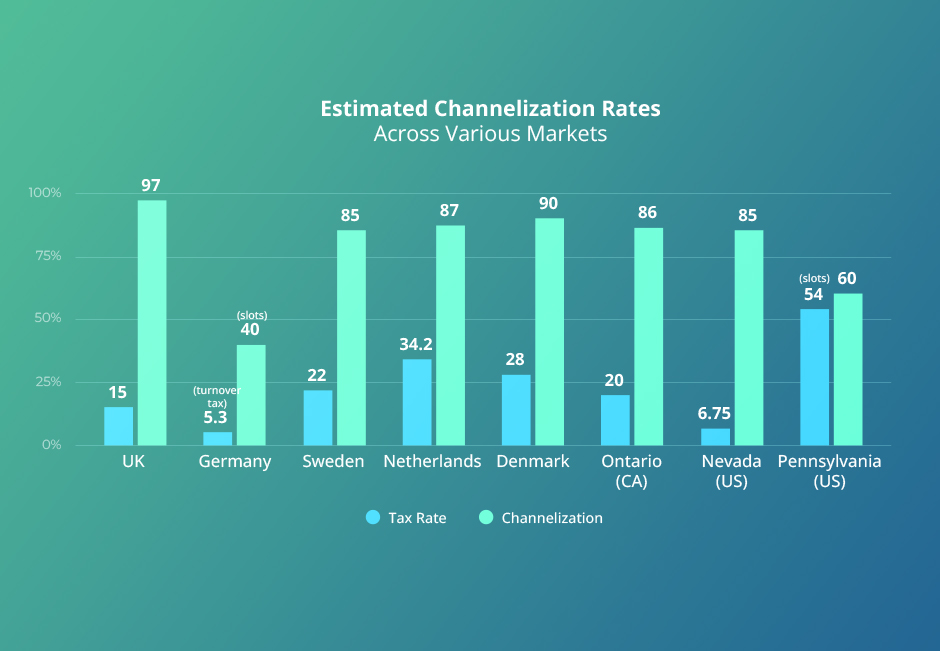

In 2016, Copenhagen Economics conducted a study on channelization and tax revenues. The study showed that the optimal tax rate for high channelization and tax revenues is around 15-20%, based on the Gross Gaming Revenue (GGR).

When comparing this to regions with a tax rate of 20% or above, channelization tends to drop below 80% and, in some cases, even lower.

So, how does channelization influence player protection? In regions where the tax rate exceeds 20%, gambling operators become less competitive. As a result, users often favor offshore platforms that may not promote responsible gambling measures like deposit and time limits, leading to an increase in addiction.

Let’s take a look at some examples from key markets:

- UK – The moderate remote gaming duty of 21% results in a channelization rate of 90% and higher. This allows regulators to prioritize player protection policies across all licensed platforms.

- Germany – The channelization for online slots has dropped below 40%, according to Deutscher Online Casinoverband (DOCV). Many operators have criticized the introduction of a 5.3% turnover tax (rather than GGR) on each wager as the main culprit, arguing that it hampers competition.

- The Netherlands and Denmark – Both have relatively high channelization rates despite lofty tax rates, possibly due to strict advertising policies and other factors. However, both regions have launched schemes to combat illegal operators, underlining a decrease in channelizing.

- US – The results are varied, given tax laws differ from state to state. Nevada has a favorable tax regime, resulting in fairly positive channelization rates. Meanwhile, Pennsylvania imposes significant taxes (54% for slots), allowing unregulated platforms to flourish.

- Brazil – Regulated online gambling and betting launched in January, 2025. Legislators have set the tax rate at 12% on GGR for operators, so it will be interesting to see how the channelization rate responds over time.

Impact of Gambling Revenue on GDPs

According to Statista, revenue in the global gambling market is projected to reach $477.30bn in 2025. The US will generate the most with $121.30bn.

It’s safe to say that gambling is a significant economic contributor, with tax revenue serving several public services, addiction treatment programs, and more. For example, in the UK, gambling activities roughly contribute 0.6% of the GDP, with an estimated $4.2bn in taxes generated in 2023-24.

As a country with a moderate tax regime, the UK uses the funds to invest in various player protection programs through the Gambling Commission. That includes research, prevention, and treatment initiatives like GamCare, which reported a 25% increase in contacts to the national helpline in 2023-2024.

| Gross Gaming Revenue (GGR) as a Share of GDP in European Countries | |

|---|---|

| Country | GDP Contribution |

| Netherlands | 0.38% |

| Germany | 0.42% |

| Denmark | 0.47% |

| Sweden | 0.52% |

| Belgium | 0.42% |

| Cyprus | 0.75% |

| Greece | 1.16% |

| Portugal | 0.89% |

Meanwhile, Germany has a relatively moderate GDP contribution, even though the government collected an estimated $5.3bn in tax on gambling activities in 2022-23. The tax benefits come with the challenge of sustaining channelization rates. That means higher rates may negatively impact legal market activities.

Taxation VS. Player Protection

So, does high taxation have a negative or positive impact on player protection and, as a consequence, addiction rates?

While high taxation can generate more government revenue to fund responsible gambling programs and regulatory control, the downside is that it may push players toward unlicensed platforms, reducing access to responsible gambling tools.

The World Health Organization estimates that 1.2% of the global adult population has a gambling problem.

Compared to high-tax countries like Germany and the Netherlands, where addiction rates are much higher than average, the notion that increased taxation lowers addiction risks does not bode well.

In Germany, a recent report (Gambling Atlas of Germany 2023) estimates that 1.3 million people (2.3% of the population) have a gambling disorder. Similarly, a Dutch report by market analysts LADIS revealed that problem gambling behavior affects 3.8% of citizens in the Netherlands.

| Global Gambling Addiction Rates VS. Tax Rates | ||

|---|---|---|

| Country | Addiction Rate | Tax Rate Low to High |

| Australia | 3.1% | Moderate-High |

| Canada | 3.2% | Moderate-High |

| US | 1.0% | Low-High |

| Austria | 1.1% | High |

| Denmark | 3.2% | Moderate-High |

| France | 2.9% | High |

| Germany | 2.3% | High |

| Italy | 3.0% | Moderate-High |

| Sweden | 4.0% | Moderate |

| UK | 2.8% | Moderate |

| Sources: National Council on Problem Gambling (NCPG), Quit Gamble | ||

Conclusion: Our Final Thoughts

The correlation between taxation and gambling addiction rates varies per region. However, countries with moderate taxation and robust regulation,like the UK and Sweden show better player protection levels. That said, Sweden has a much higher addiction rate than other EU markets, meaning regulators can do more to impose stricter responsible gambling policies.

Meanwhile, countries with high-tax models, like the Netherlands and Germany show leaks in their channelization rates. To address this, authorities may need to reassess their taxation policies to remain competitive. There may also be a gap in educating players about the advantages of using regulated platforms.

Finally, most countries in the global gambling market are demonstrating moderate to high addiction rates, meaning governments, regulators, and operators are not doing enough and must work together for player protection and establish a well-regulated, thriving industry.