Germany’s Tax System: How Lower RTP Impacts Players and Operators

In 2021, Germany introduced a 5.3% turnover tax on every wager on online slots, leading to lower RTP rates. As a result, the online casino tax revenue dropped by 16% in 2024 (following another decline in 2023). The channelization rate for online slots is estimated to have plummeted to below 40%.

Two of the main goals of the Interstate Treaty on Gambling (Glücksspielstaatsvertrag) – minimizing illegal gambling activities and boosting the legal sector – remain unmet. Let’s explore how the gambling tax system in Germany leads to lower RTPs (Return to Player) and how this affects players and operators nationwide.

The Impact of Lower RTP on Players

Germany’s higher gambling tax burden has made it impossible for online casinos to offer return-to-player rates above 94.7% without incurring losses. To be profitable, a platform should put a cap at about 92-93% or lower, which is below the industry average of 95%.

Let’s visualize player loss rates with a simple example:

- If you have an initial bankroll of 100€ and play an online slot with an RTP rate of 95%, the expected loss for every 1€ spin is 0.05€. After 100 spins, your bankroll will be down to 95€, meaning you suffer a total loss of 5€.

- If a slot has a lower RTP rate of 90%, the expected loss for every 1€ spin is higher at 0.10€. After 100 spins, your bankroll will be 90€, meaning you lose a total of 10€.

In other words, your accumulated loss increases by 50% with just a 5% difference in the payout rate. This may push some players toward offshore or unlicensed platforms in search of better returns — a trend regulators aim to prevent.

In the last few years, there have been some other changes that don’t sit well with many German gamblers, including the following restrictions:

- 1€ max bet per spin on virtual slots

- 1,000€ max monthly limit on deposits (exceptions possible)

- 5-second rule to online slots

- No jackpot slots are allowed

- No autoplay function in slots

The 1,000€ maximum deposit limit per month is subject to exceptions. However, to increase it, you’ll have to undergo an affordability check and set a 20% monthly loss limit. The 5-second delay between spins in slots is mandatory and can’t be avoided.

It is also worth mentioning that Schleswig-Holstein is the only German state that allows RNG and live table games. North Rhine-Westphalia plans to start implementing online table games in mid-2025, but the outcome is not clear currently.

All these limitations lead to frustration and drive gamblers from GGL-licensed platforms to offshore and illegal operators. According to a 2023 study by the University of Leipzig, German Online Casino Association (DOCV) and the German Sports Betting Association (DSWV), nearly half of German players are still using the black market.

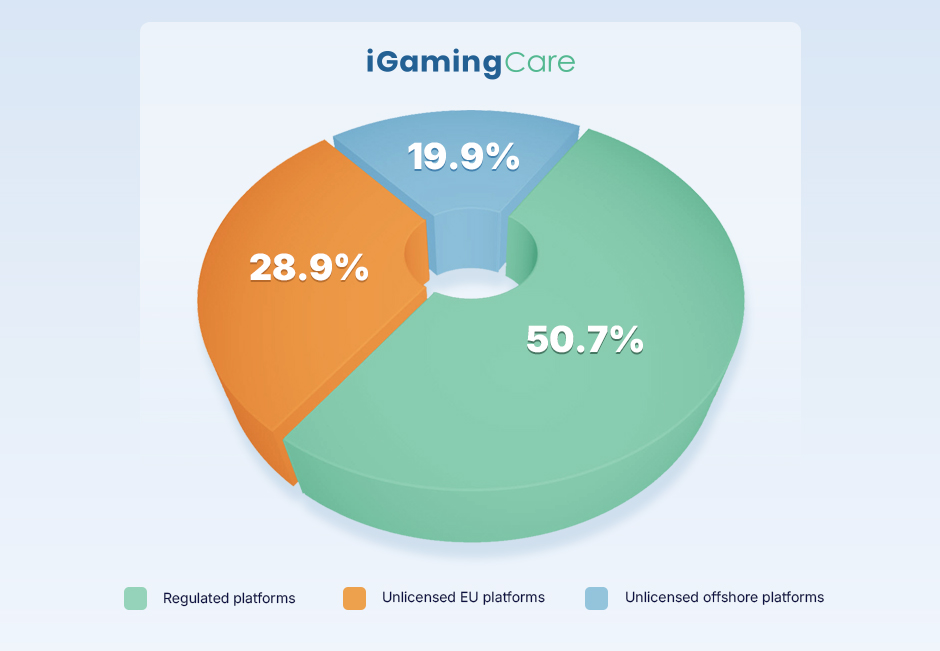

The channelization rate for regulated online gaming platforms was estimated at 50.7%. A staggering 28.9% of traffic was to unlicensed EU providers, and 19.9% was to unlicensed offshore operators. This could lead to gambling-related harm, such as higher addiction rates, inability to access your winnings, and other financial fraud.

The Impact of Lower RTP on Operators

Licensed online casinos in Germany abide by strict regulations. They pay all applicable fees and taxes and offer the best gambling conditions in terms of safety. At the same time, they’re also struggling to compete with offshore and unregulated platforms, especially when it comes to payout rates.

The 5.3% turnover tax on online slots leads to reduced profitability. Lower RTPs make it difficult for German casinos to offer better winning opportunities. Tight operational costs also hinder the potential for investments in customer acquisition and retention campaigns.

In 2024, this resulted in a channeling rate less than 40% for online slots. This is extremely low, especially compared to other European countries.

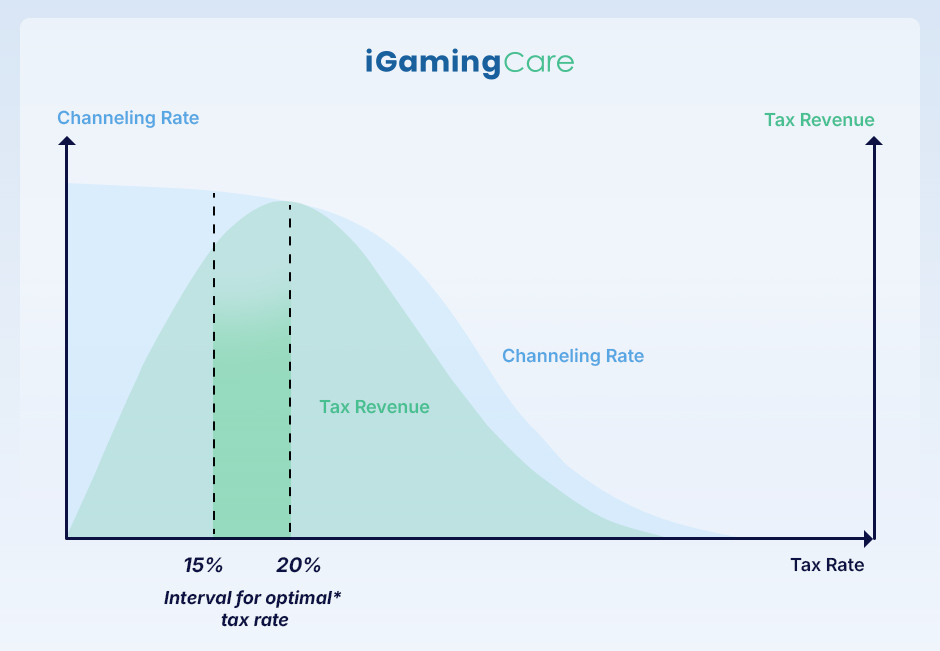

The optimal channelization rate is over 80%. According to a study by Copenhagen Economics, this is best achieved with a gambling tax between 15% and 20% of Gross Gaming Revenue (GGR).

In Germany, the gambling tax on online slots is not based on GGR. That said, the accumulated cost is also significantly higher compared to other countries. That’s why experts believe that the German Online Casino Association (DOCV) needs to take urgent action and make changes to ensure that the regulated market becomes more attractive to players.

Potential Solutions to Address the Situation

Several potential solutions could be applied to try and minimize the current struggles faced by licensed online casinos in Germany:

- Reducing the tax burden for operators – This can be done by either implementing a GGR-based tax system, similar to other European countries, or lowering the 5.3% turnover tax.

- Simplifying the licensing process and reducing compliance costs – This will result in lower operational expenses, allowing gambling platforms in Germany to increase payout rates without sacrificing profitability.

- Mixing games with different RTPs – Games with higher return-to-player rates will attract new players, whereas lower RTP games will maintain profitability.

- Educating players – It could also be beneficial to educate players on the importance of responsible gambling and familiarize them with the full scope of the black market threat.

- Applying strict policies to combat unregulated platforms – Some European countries like the Netherlands and Denmark have already done that and experienced an increase in their channeling rates.

In a recent statement for a gambling news outlet, a GGL spokesperson said that the regulator is currently focused on limiting illegal operations and making the legal market more attractive.

Is the German Model Sustainable or a Ticking Time Bomb?

When Germany legalized online casinos in 2021, the primary goal was to mitigate the influence of offshore and unregulated platforms and ensure players gamble at licensed operators only. So far, however, this has not been achieved. That’s why the sustainability of Germany’s current gambling tax system is subject to debate.

Other countries, such as the UK, Denmark, and Sweden, have applied a more moderate taxation approach and reported better results. We believe Germany should refine its gambling tax policy to not hinder operators’ RTP rates. It should strike the right balance between profitability and player satisfaction.